Tag Archives: Pru MyChild

When can I sign up insurance plan for my baby? Prudential Education Plan and Health Medical Insurance

Posted in Insurance / Takaful

Tagged agent no 1 prudential malaysia, Cover Pregnancy Complications, Cover while pregnant, Education Plan, health insurance, Health Medical Insurance, Insurance, insurance for children, insurance for expatriate, insurance for foreigners, insurance for kids, insurance for lady, insurance for woman, insurance malaysia, Malaysia, maternity insurance, Medical Card, Medical Insurance, pregnancy insurance, Pru My Child, Pru MyChild, Prudential, Prudential Education Plan, Prudential Medical Card, PRUmy child, PRUmychild, risk insurance, Savings for Children, What is PruMy Child, What is PruMyChild

PRUbest Start AND PRUearly Start (PRU mychild)

What is the difference between PRUbest start and PRUearly start?

PRUearly start is basic cover for both mother and child during the pregnancy and early infancy period while PRUbest start gives a wider coverage including pregnancy complications.

How does PRUbest start and PRUearly start work?

These benefits cover both the mother and the child even before he/she is born during the crucial pregnancy and ceases when the child is 2 year old. During the pregnancy period up to 30 days from birth of child, the pregnant mother is covered under Pregnancy Care Benefit:

Note: Only 3 types of pregnancy complications are covered in PRUbest start:

(1) Abruptio Placentae (premature separation of the placenta from the womb)

(2) Eclampsia (seizure activity and/or unexplained coma during/after pregnancy)

(3) Amniotic fluid embolism (amniotic fluid entering into mother’s blood circulation)

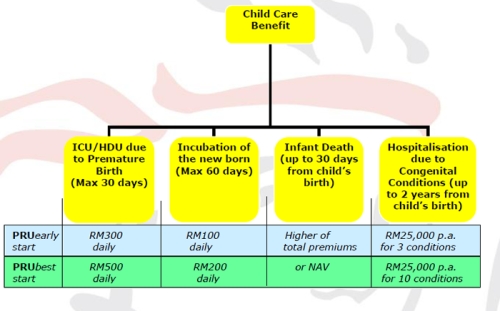

From the moment the child is born, he/she is immediately covered under Child Care Benefit up to age 2 year old:

Congenital conditions covered under:

PRUearly start

- Anal atresia (absence of the anus opening)

- Congenital Cataract (clouding of the eyes)

- Congenital Deafness (loss of hearing)

PRUbest start

- Infantile Hydrocephalus (head enlargement due to excessive fluid in the brain)

- Anal atresia (absence of the anus opening)

- Congenital Diaphragmatic Hernia (opening of the diaphragm that cause the organs in the abdomen to go up into the chest cavity)

- Atrial Septal Defect (abnormal opening between the heart’s upper left and right chambers. A form of hole in the heart conditions)

- Tetralogy of Fallot (heart conditions with 4 major defects that causes the baby to turn blue due to lack of oxygen)

- Transposition of Great Vessels (switch of position between the heart’s aorta and pulmonary artery. Aorta is rich in oxygen while pulmonary artery is poor in oxygen)

- Truncus Arteriosus (merging of the heart’s aorta and pulmonary artery)

- Ventricular Septal Defect (abnormal opening of the wall between the heart’s left and right lower chamber. A type of hole in the heart conditions)

- Congenital Cataract (clouding of the eyes)

- Congenital Deafness (loss of hearing)

Who is eligible to apply for PRUbest start and PRUearly start?

Any woman age between 18-45 next birthday that is within week 18-35 of her pregnancy. For woman age 18-45 next birthday but ABOVE 35 weeks of pregnancy, they can still secure a policy for their unborn child but PRUearly start and PRUbest start will not be applicable. If death of foetus or death of child occurs within the 30 from birth of child, the higher of total premiums paid or value of units will be paid. However, no coverage will be provided on the mother.

Why is the Congenital Conditions separated into 2 different groups?

PRUbest start provides a more comprehensive protection for the child and this is not only evidenced by the amount of benefit payable but the covered congenital conditions.

What happens when it is a twin pregnancy?

If twin is detected, applicant will be required to purchase to TWO identical policies with same coverage. This is to avoid anti-selection against Company in the event either one of the child is born unhealthy or with complications.

What is the waiting period for PRUbest start and PRUearly start?

These benefits start protecting both the pregnant mother and the growing foetus immediately once the cover commenced after underwriting and premium is paid since there is no waiting period applicable for these 2 benefits.

Can we switch between the 2 benefits or make any changes to the other benefits attached to the policy at a later stage?

Since pregnancy can be rather unpredictable, no switching between PRUbest start and PRUearly start is allowed once the policy is incepted. Also, no changes can be made on the other benefits attached to the policy until the child is born. Any change of benefits after the birth of the child is subjected to underwriting.

What are the documents required during proposal stage?

In addition to the usual documents submitted i.e. proposal form, sales illustration and lifestyle profile, all pre-birth applicants will need to submit a gynaecology report (Form ID: 10201065) completed by their attending gynaecologist. This form can be downloaded from RAISe under New Business Medical Form. In addition to that, a 3D/4D scan will be required if PRUbest start is selected.

Who will bear the cost of the gynaecology report and 3D/4D scan?

The cost of gynaecology report (up to RM150) will be borne by the Company while the 3D/4D scan shall be at the expense of the applicant.

Upon expiry of PRUbest start/PRUearly start, will the premium be reduced?

Once the benefit expires at age 2, policyholder is free to utilize the premium to further increase their child’s cover or to enhance their investments.

After the child is born, what should the parent do?

The parent should update the child’s details i.e. name of the child, date of birth, gender, birth certificate/MyKid identity card number by providing to the Company of a copy of the birth certificate/MyKid identity card. Without any update on the child’s details, all types of transaction including surrender of the policy will not be allowed.

Posted in Insurance / Takaful

Tagged Cover Pregnancy Complications, Cover Pregnancy Complications·Cover while pregnant·Education Plan·Insurance·Malaysia·Medical Card·Pru My Child·Pru MyChild·PRUbest start·Prudential·PRUearly start·PRUmy child·PRUmychild·S, Cover while pregnant, Education Plan, Insurance, Malaysia, Medical Card, Pru My Child, Pru MyChild, Prudential, PRUmy child, PRUmychild, Savings for Children, What is PruMy Child, What is PruMyChild

PRUmy child. Promotional Contest. Join now!

Win RM30,000 Education Plan for your children

Free personal accident coverage for newborn babies

Watch Sheild Majid promotional video. Why she choose PRUmy child?

Posted in Insurance / Takaful

Tagged Cover Pregnancy Complications, Cover while pregnant, Education Plan, Insurance, insurance for children, insurance for kids, insurance for lady, insurance for woman, Malaysia, maternity insurance, Medical Card, pregnancy insurance, Pru My Child, Pru MyChild, Prudential, PRUmy child, PRUmychild, risk insurance, Savings for Children, What is PruMy Child, What is PruMyChild

PRUmy child. Protection and education for your child

Protection and education for your child. On top of that, you could also enjoy these tantalising goodies:

* 1st 200 PRUmy child policyholders receive a free voucher each

* 1st 2000 PRUbest start policyholders enjoy a free smock each.

* Newborn babies receive FREE Personal Accident coverage

Interested?

Please email me as below

PRUmychild (before birth)

1. Name of Mother

2. Date of Birth (Mother)

3. Smoking or not

4. Annual Income

5. Contact Number

6. Location

7. How many weeks of pregnancy?

8. Expected Delivery Date

9. Budget monthly (RM100 and above)

PRUmychild (after birth)

1. Name of Father/Mother

2. Date of Birth Father/Mother

3. Smoking or not

4. Annual Income

5. Contact Number

6. Location

7. Date of Birth Kids

8. Budget monthly (RM100 and above)

Posted in Insurance / Takaful

Tagged agent no 1 prudential malaysia, Cover Pregnancy Complications, Cover while pregnant, Education Plan, H1N1, health insurance, Insurance, insurance for children, insurance for expatriate, insurance for foreigners, insurance for kids, insurance for lady, insurance for woman, insurance malaysia, Malaysia, maternity insurance, Medical Card, Medical Card till age 100, Medical Insurance, Non Claim Bonus, pregnancy insurance, Protection and education for your child, Pru Health, Pru Health Malaysia, Pru My Child, Pru MyChild, Prudential, Prudential Medical Card, PruHealth, PruHealth Malaysia, PRUmy child, PRUmychild, risk insurance, Savings for Children, What is PruHealth, What is PruMy Child, What is PruMyChild

All about PRUmy child. Health insurance start from pregnancy.

What is PRUmy child?

PRUmy child is a regular premium investment-linked insurance plan that serves to fulfill

the protection needs of you and your child, allowing you to plan ahead for their

future… today.

What are the benefits available in this plan?

For the child

Should the unfortunate happen to your child, such as death, the benefit payable is the:

• Sum assured & total value of units in the account1

Should your child suffer from Total and Permanent Disability (TPD):

(a) before the age of 16 years, the maximum sum assured is payable (subject to RM500,000 per life); or

(b) after age 16 years but prior to age 70, the maximum sum assured is payable (subject to a total of RM4 million per life)

In the event of TPD, the sum assured is payable subject to a maximum lump sum of RM1 million upon claim. The balance of the sum assured will be paid upon the first anniversary of the TPD. Upon earlier death, the balance of any sum assured will be paid immediately.Upon maturity of plan

Value of all units in the account is payable when your child reaches the age of 100

years on their next birthday.Upon surrender

Value of units in the account at the point of surrender.For a pregnant mother

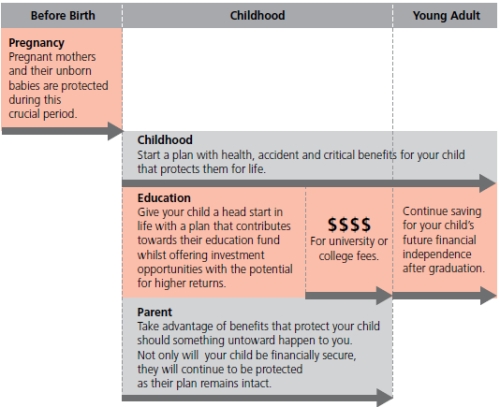

It’s never too early to start protection with PRUearly start or PRUbest start benefit that offers Child Care Benefit and Pregnancy Care Benefit for pregnant mothers and their unborn child.

Please refer to the PRUearly start / PRUbest start Leaflet for further details

Who can take up the PRUmy child plan?

You can take up this plan for your unborn child as early as 18 weeks into your pregnancy, or for your child who is between 1 – 18 years of age on his / her next birthday. The parent, who must be between 18 – 60 years old, owns the policy and is able to adapt it as they see fit for the benefit of the child.

How long do I need to pay premiums for?

Premium is payable throughout the whole policy term until the expiry of the policy. Upon expiry of any optional or add-on benefits, the premiums will be reduced accordingly.

How can I enhance the coverage of the PRUmy child plan?

With additional premium, you can extend the PRUmy child plan beyond the ordinary by attaching any of the following optional / add-on cover that will insure your child and loved ones against unexpected events:

Critical Illness Cover

Takes care of your child in the event they are diagnosed with critical illness, including child-specific illnesses under the new PRUessential child1 rider that covers them up to the age of 25 years next birthday.Payor Cover

Pays for your plan in the event of death (if applicable), TPD before age 70 or critical illness.Accident Cover

Comprehensive coverage for injuries due to accident.Health and Medical Cover (PRUhealth)

Takes care of major medical bills in the event that your child needs surgery or outpatient treatment and if he or she is hospitalised.

How do I start building my child’s education fund?

You can attach either PRUsaver kid or PRUedusaver where the premiums will be invested in our series of PRUlink or PRUlink education funds.

Is PRUmy child eligible for tax relief?

During childhood

As a parent, you should be entitled to education tax relief on premiums paid for PRUedusaver, PRUsaver

kid or Parent Payor. Furthermore, premiums paid for PRUfamily income, PRUfamily double income and PRUessential child may also qualify for tax relief.During adulthood (Above age 25 at next birthday)

Your child will be entitled to life / medical tax relief upontransfer of ownership.

Posted in Insurance / Takaful

Tagged agent no 1 malaysia, agent no 1 prudential malaysia, ampang, bandar tun razak, bandar utama, bangsar, bukit bintang, bukit tinggi, cheras, Cover Pregnancy Complications, Cover while pregnant, damansara, Education Plan, ejen prudential, firdaus prudential, gombak, H1N1, health insurance, Insurance, insurance for children, insurance for expatriate, insurance for foreigners, insurance for kids, insurance for lady, insurance for woman, insurance malaysia, Kad Perubatan, kelana jaya, keramat, klang, klcc, kota damansara, kuala lumpur, kuchai lama, Malaysia, maternity insurance, Medical Card, Medical Card till age 100, Medical Insurance, mont kiara, Non Claim Bonus, petaling jaya, pregnancy insurance, Pru Health, Pru Health Malaysia, Pru My Child, Pru MyChild, Prudential, prudential blog, Prudential Medical Card, PruHealth, PruHealth Malaysia, PRUmy child, PRUmychild, puchong, putra heights, putrajaya, rawang, risk insurance, Savings for Children, selangor, setiawangsa, shah alam, subang jaya, sungai buloh, sunway, TTDI, wangsa maju, What is PruHealth, What is PruMy Child, What is PruMyChild

What is PRUmychild. Health and Medical Insurance for baby from Prudential

COMPLETE PROTECTION for every stage in your child’s life… even BEFORE BIRTH

PRUmy child gives you control and flexibility to design a complete plan for your child. Offering an unparalleled choice of protection benefits ranging from health, hospitalisation, accidental and critical illness benefits, you can be confident that your child’s future is secure.

Aiming to give you peace of mind when it comes to your child’s needs, the new PRUearly start and PRUbest start benefit under this plan offers your child protection during the crucial pregnancy and infancy periods under the Pregnancy Care Benefit and Child Care Benefit.

A Simple Illustration of how PRUearly start and PRUbest start works

Congenital conditions covered under:

PRUearly start

- Anal atresia

- Congenital Cataract

- Congenital Deafness

PRUbest start

- Anal atresia

- Atrial Septal Defect

- Congenital Cataract

- Congenital Deafness

- Congenital Diaphragmatic Hernia

- Infantile Hydrocephalus

- Tetralogy of Fallot

- Transposition of Great Vessels

- Truncus Arteriosus

- Ventricular Septal Defect

You can further secure your child’s wellbeing with the new PRUessential child that offers

coverage against child specific illnesses such as

• Severe asthma

• Leukaemia

• Insulin-dependent Diabetes Mellitus

• Rheumatic fever with valvular impairment

• Kawasaki Disease with heart complications

• Severe juvenile rheumatoid arthritis

• Glomerulonephritis with Nephrotic Syndrome

• Severe epilepsy

• Intellectual Impairment due to illnesses or accident

Please contact me for brochure

Posted in Insurance / Takaful

Tagged ampang, Child Care Benefit., Cover Pregnancy Complications, Cover while pregnant, damansara, Education Plan, gombak, H1N1, Health and Medical Insurance for baby, Insurance, keramat, klang, kota damansara, kuala lumpur, kuchai lama, Malaysia, Medical Card, Medical Card till age 100, Non Claim Bonus, Pru Health, Pru Health Malaysia, Pru My Child, Pru MyChild, PRUbest start, Prudential, prudential agent, Prudential BSN Takaful, Prudential Insurance, Prudential Life Insurance, Prudential Malaysia, PRUearly start, PRUessential child, PruHealth, PruHealth Malaysia, PRUmy child, PRUmychild, puchong, putrajaya, rawang, regnancy Care Benefit, Savings for Children, selangor, shah alam, sungai buloh, TTDI, What is PruHealth, What is PruMy Child, What is PruMyChild

Britain's Prudential to buy AIA for $35.5 billion

Prudential taps Asia sovereign funds over AIA deal

British insurer Prudential is tapping sovereign wealth funds in China and Singapore to help finance its 35.5 billion dollar buyout of US insurance giant AIG’s Asian arm, a report said Tuesday.

The Financial Times quoted unidentified sources as saying that Prudential and its advisers were in talks with the sovereign wealth funds to support a planned 20 billion-dollar share offer for AIA.

It said the Singaporean and Chinese sovereign wealth funds had not made a final decision but their response was positive.

Singapore’s Temasek Holdings and China Investment Corp (CIC), among the region’s major sovereign wealth funds, would not comment on whether they had been approached by the British insurer.

“It is inappropriate for us to comment on market speculation,” a spokeswoman for Temasek Holdings said in a statement to AFP.

A CIC spokeswoman said the fund has seen the newspaper report but added it was company policy not to comment on rumours.

Asked about its market strategy, the CIC spokeswoman said: “As an investment institution, we make financial portfolio investment and seek medium- to long-term, risk-adjusted returns at a reasonable level. These have been the principles we always follow.”

Prudential on Monday agreed to buy AIA for 35.5 billion US dollars in the insurance sector’s biggest ever takeover.

The acquisition of AIA will transform Prudential into the world’s top non-Chinese insurer by market capitalisation, ahead of major competitors Allianz and AXA.

Under the acquisition terms, the British firm will pay AIG 25 billion US dollars in cash and the remaining 10.5 billion US dollars in new Prudential shares and other securities.

The Financial Times said Prudential is planning a rights issue of 20 billion US dollars, giving existing shareholders in the British insurer the right to buy the shares first.

Should the shareholders decide not to take up the offer, the sovereign wealth funds will then invest in the offering, it said.

Prudential’s group chief executive Tidjane Thiam said that Asia is the “most attractive opportunity in our industry today”, partly because of the region’s strong savings habits.

“Asia is the engine of the group’s future growth, particularly the fast growing economies in Southeast Asia,” he said.

“Asia is complex, dynamic and exciting, and its economies differ significantly, with varying levels of economic development, from the OECD members, Japan and Korea, to the fast growing markets of Southeast Asia, such as Indonesia and Malaysia.”

Sales in Asia already make up half of new contracts for Prudential across a number of countries including China, India, Indonesia, Malaysia and Thailand. The company also has a strong presence in Britain and the United States.

?

Posted in Financial

Tagged ampang, Britain's Prudential, Cover Pregnancy Complications, Cover while pregnant, damansara, Education Plan, gombak, H1N1, Insurance, keramat, klang, kota damansara, kuala lumpur, kuchai lama, Malaysia, Medical Card, Medical Card till age 100, Non Claim Bonus, Pru Health, Pru Health Malaysia, Pru My Child, Pru MyChild, Prudential, prudential agent, Prudential BSN Takaful, Prudential Insurance, Prudential Life Insurance, Prudential Malaysia, Prudential taps Asia sovereign funds over AIA deal, Prudential to buy AIA, PruHealth, PruHealth Malaysia, PRUmy child, PRUmychild, puchong, putrajaya, rawang, Savings for Children, selangor, shah alam, sungai buloh, TTDI, What is PruHealth, What is PruMy Child, What is PruMyChild

Product Disclosure for PRUlink assurance plan . Waiting Period. Free look Period

PRUlink assurance plan is a regular premium investment linked whole life plan. This investment-linked policy (ILP) offers a combination of insurance protection and investment. The basic plan pays a lump sum death benefit (i.e. the sum assured) and the value of the investment units, at the time of claim, if you are totally and permanently disabled before age 70 or die, during the term of the policy.

The insurance company allocates a portion of the premium to purchase units in the investment-linked fund that you have chosen.

Illustrated below is the premium allocation rate for a benefit term of 20 years and above. For benefit term below 20 years, the premium allocation rate will be scaled up proportionately.

![]()

The value of the ILP depends on the price of the underlying units, which in turn depends on the performance of your chosen fund.

Free-look period – you may cancel your ILP by returning the policy within 15 days after you have received the policy. The insurance company will refund to you the unallocated premiums, the value of units that have been allocated (if any) at unit price at the next valuation date and any insurance charge and policy fee that have been deducted less any medical fee incurred.

Critical illness benefits under the policy will only start 60 days after the effective date of the policy for heart attack, coronary artery disease and cancer and 30 days for all other illnesses

PRUhealth and PRUannual limit waiver under the policy will only start 120 days after the effective date of the policy for specified illnesses and 30 days for all other illnesses. Cover for hospitalisation due to accidents commences immediately.

PRUmed and/or Hospital Benefit under the policy will start immediately for hospitalisation due to accidents and 30 days for any other causes

Co-insurance – you will have to pay 10% of the total costs incurred, subject to maximum of RM1,000 for Hospital & Surgical Benefit and RM2,000 for Outpatient Treatment Benefit.

Posted in Insurance / Takaful

Tagged ampang, Cover Pregnancy Complications, Cover while pregnant, damansara, Education Plan, Free look Period, gombak, Grace Period, H1N1, Insurance, keramat, klang, kota damansara, kuala lumpur, kuchai lama, Malaysia, Medical Card, Medical Card till age 100, Non Claim Bonus, Pru Health, Pru Health Malaysia, Pru My Child, Pru MyChild, Prudential, prudential agent, Prudential BSN Takaful, Prudential Insurance, Prudential Life Insurance, Prudential Malaysia, PruHealth, PruHealth Malaysia, PRUlink assurance plan, PRUmy child, PRUmychild, puchong, putrajaya, rawang, Savings for Children, selangor, shah alam, sungai buloh, TTDI, Waiting Period, What is PruHealth, What is PruMy Child, What is PruMyChild

Life Insurance Tax Release. Pelepasan cukai insurans.

| Bil. | Jenis Potongan Individu | Amaun (RM) |

| 1 | Individu dan saudara tanggungan | 9,000 |

| 2 | Perbelanjaan Perubatan Ibu Bapa | 5,000 (Terhad) |

| 3 | Peralatan Sokongan Asas | 5,000 (Terhad) |

| 4 | Individu Kurang Upaya | 6,000 |

| 5 | Yuran Pendidikan (Sendiri) | 5,000 (Terhad) |

| 6 | Perbelanjaan perubatan penyakit yang sukar diubati | 5,000 (Terhad) |

| 7 | Pemeriksaan perubatan penuh | 500 (Terhad) |

| 8 | Pembelian buku/majalah/jurnal/penerbitan | 1,000 (Terhad) |

| 9 | Pembelian komputer peribadi untuk individu | 3,000 (Terhad) |

| 10 | Tabungan bersih dalam skim SSPN | 3,000 (Terhad) |

| 11 | Pembelian peralatan sukan untuk aktiviti sukan | 300 (Terhad) |

| 12 | Suami/Isteri/Bayaran alimoni kepada bekas isteri | 3,000 (Terhad) |

| 13 | Suami/Isteri kurang upaya | 3,500 |

| 14 | Anak di bawah umur 18 tahun | 1,000 |

| 15 | Anak berumur 18 dan ke atas, belum berkahwin dan menerima pendidikan sepenuh masa | 1,000 |

| 16 | Anak berumur 18 dan ke atas, belum berkahwin dan mengikuti diploma ke atas di dalam Malaysia @ peringkat ijazah ke atas di luar Malaysia dalam kursus dan di IPT yang diiktiraf oleh pihak berkuasa Kerajaan yang berkaitan | 4,000 |

| 17 | Anak Kurang upaya

Pelepasan tambahan sebanyak RM4,000 bagi anak kurang upaya berumur 18 dan ke atas, belum berkahwin dan mengikuti diploma ke atas di dalam Malaysia @ peringkat ijazah ke atas di luar Malaysia dalam kursus dan di IPT yang diiktiraf oleh pihak berkuasa Kerajaan yang berkaitan |

5,000 |

| 18 | Insuran nyawa dan KWSP | 6,000 (Terhad) |

| 19 | Insurans pendidikan dan perubatan | 3,000 (Terhad) |

Posted in Insurance / Takaful

Tagged ampang, Cover Pregnancy Complications, Cover while pregnant, damansara, Education Plan, gombak, H1N1, Insurance, keramat, klang, kota damansara, kuala lumpur, kuchai lama, Life Insurance Tax Release, Malaysia, Medical Card, Medical Card till age 100, Non Claim Bonus, Pelepasan cukai insurans, Pru Health, Pru Health Malaysia, Pru My Child, Pru MyChild, Prudential, prudential agent, Prudential BSN Takaful, Prudential Insurance, Prudential Life Insurance, Prudential Malaysia, PruHealth, PruHealth Malaysia, PRUmy child, PRUmychild, puchong, putrajaya, rawang, Savings for Children, selangor, shah alam, sungai buloh, TTDI, What is PruHealth, What is PruMy Child, What is PruMyChild

Prudential Insurance Malaysia. Always Listening Always Understanding. TV Commercial

New TV Commercial by Prudential.

Always Listening Always Understanding

Posted in Insurance / Takaful

Tagged Always Listening Always Understanding, ampang, bandar tun razak, bandar utama, bangsar, bukit bintang, bukit tinggi, cheras, Cover Pregnancy Complications, Cover while pregnant, damansara, Education Plan, gombak, H1N1, Insurance, kelana jaya, keramat, klang, kota damansara, kuala lumpur, kuchai lama, Malaysia, Medical Card, Medical Card till age 100, mont kiara, Non Claim Bonus, petaling jaya, Pru Health, Pru Health Malaysia, Pru My Child, Pru MyChild, Prudential, Prudential advertising, prudential agent, Prudential BSN Takaful, Prudential Insurance, Prudential Insurance Malaysia, Prudential Life Insurance, Prudential Malaysia, Prudential TV commercial, PruHealth, PruHealth Malaysia, PRUmy child, PRUmychild, puchong, putra heights, putrajaya, rawang, Savings for Children, selangor, shah alam, sungai buloh, TTDI, What is PruHealth, What is PruMy Child, What is PruMyChild